SUPPORT

SUPPORT

FOR INVESTORS

INCOME TAX EXEMPTIONS

INCOME TAX EXEMPTIONS

Investors can enjoy income tax exemptions given on the basis of the Act on Supporting New Investments. Krosno and the Sub-Carpathian Region (Podkarpacie) have the highest limit of public aid available within the European Union, thanks to which investors are able to obtain much higher tax exemptions than in the central and western regions of Poland.

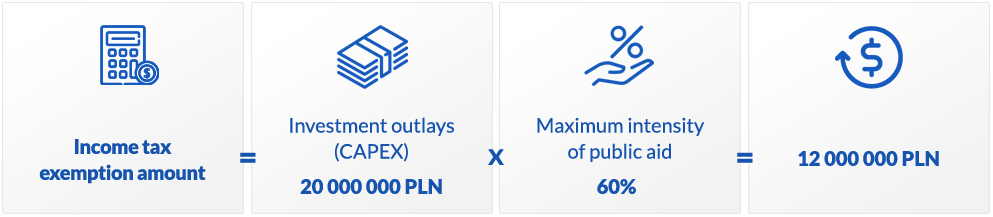

The amount of the aid granted to an entrepreneur is a product of maximum public aid intensity and the cost to be qualified for being comprised by the aid.

| Enterprise size | Number of employees | Annual turnover | Total annual balance sheet | Maximum intensity of public aid |

|---|---|---|---|---|

| MICRO | <10 | ≤ EUR 2m | ≤ EUR 2 m | 70% |

| SMALL | <50 | ≤ EUR 10 m | ≤ EUR 10 m | 70% |

| MEDIUM | <250 | ≤ EUR 50 m | ≤ EUR 43 m | 60% |

| LARGE | ≥250 | > EUR 50 m | > EUR 43 m | 50% |

Public aid is granted on account of the following:

Public aid is granted on account of the following:

1. The cost of new investment – the amount of the aid provided is calculated as a product of maximum public aid intensity and the cost qualified as being eligible for the aid, which is:

- the purchase of land or the right of perpetual usufruct of land,

- the purchase or manufacture of fixes assets,

- the expansion or modernization of existing fixed assets,

- the purchase of intangible and legal assets connected with a process technology transfer,

- costs connected with rental or lease of land, buildings and structures, provided that the term of rental or lease is at a minimum of 5 years (for a large enterprise) or 3 years (SME) from a scheduled date of completion of the new investment,

- financial leasing of assets other than land, buildings and structures, subject to the obligation to purchase them upon the expiry date of a rental or lease.

2. The creation of new jobs – the amount of the public aid is calculated as a product of maximum public aid intensity and two-year costs of employment of newly hired employees.

Example:

Enterprise size: MEDIUM

Investment outlays (CAPEX): PLN 20 000 000 (including land, buildings, machinery and equipment, patents and licences)

Maxumum level (intensity) of public aid: 60%

Real estate tax exemptions – de minimis aid

Real estate tax exemptions – de minimis aid

The city offers exemptions from on Real Estate tax for investors creating new employment. The exemption covers buildings, structures or parts of them and the land connected to them.

Conditions of eligibility for tax exemption are as follows:

1) Completion of a new investment within the boundaries of Krosno, understood as construction of new buildings, structures or integral parts of them.

2) Undergoing business in a priority sector – the scope of activities should fall within the following sections, divisions, groups, and subclasses of the Polish Classification of Activities (PKD):

- Section C – Manufacturing,

- Section H – Transportation and storage – Group 52.1 – Warehousing and storage – Subclass 52.23Z – Service activities incidental to air transportation, Subclass 52.24.C Cargo handling in other reloading points,

- Secion I – Accommodation and food service activities – Group 55.1 – Hotels and similar accommodation, Group 55.2-Holiday and other short-stay accommodation,

- Section J – Information and communication – Division 58 – Publishing activities, Division 59 – Motion picture, video and television programme production, sound recording and music publishing activities, Division 60 – Programming and broadcasting activities, Division 62 – Computer programming, consultancy and related activities, Group 63.1 – Data processing, hosting and related activities; web portals,

- Section M – Professional, scientific and technical activities – Group 69.2 – Accounting, bookkeeping and auditing activities; tax consultancy, Group 71.1- Architectural and engineering activities and related technical consultancy, Division 72 – Scientific research and development,

- Section N – Administrative and support service activities – Division 79 – Travel agency, tour operator and other reservation service and related activities,

- Section P – Education – Subclass 85.53.Z Out-of- school forms of driving education- in the area of pilot schools.

Period of exemption:

| Exemption period |

Number of newly created jobs |

| 1 year | – |

| 2 years | 10 |

| 3 years | 20 |

| 4 years | 35 |

| 5 years | 50 |

The exmeption is granted as part of the ‘de minimis’ aid. The value of the ‘de minimis’ aid obtained in the period of 3 years cannot exceed Euro 300k.

Real estate tax exemptions – regional aid

Real estate tax exemptions – regional aid

The city offers property tax exemptions for investors as part of regional investment aid. The exemption covers buildings, structures, or parts thereof, as well as the associated land, constituting an initial investment.

Conditions for obtaining the exemption

1) Implementation of an initial investment, understood as:

- Investment in tangible fixed assets and intangible assets related to the establishment of a new facility, an increase in the production capacity of an existing facility, diversification of a facility’s production by introducing products or services not previously produced or provided by the facility, or a fundamental change in the entire production process of the product or products involved in the investment in the facility, or

- acquisition of assets belonging to a facility that has been closed or would have been closed had the acquisition not occurred, provided that the mere purchase of shares or equity in a company does not constitute an initial investment,

not being a replacement investment.

2) Conducting business activities in the following sections of the Polish Classification of Activities (PKD):

- Section C – Manufacturing,

- Section H – Transportation and storage – Subclass 52.10.B – Warehousing and storage of other goods, 52.24.C Cargo handling in other reloading points.

Period of exemption:

| Exemption period |

Number of newly created jobs |

Minimal value of investment eligible costs |

| 3 years | 20 | 10 million PLN |

| 6 years | 50 | 10 million PLN |

| 7 years | 100 | 20 million PLN |

| 8 years | 500 | 40 million PLN |

| 10 years | 1000 | 80 million PLN |

The exemptions are granted based on regional investment aid regulations.

The aid cap is set at:

- 50% of eligible investment costs for large enterprises,

- 60% for medium-sized enterprises,

- 70% for small and micro-enterprises.

Eligible investment costs include:

- Acquisition of ownership or perpetual usufruct rights to land,

- Costs of purchasing or constructing buildings and structures, as well as their equipment (e.g., machinery, devices, technical infrastructure, telecommunications, and more),

- The purchase price of intangible assets and legal rights, subject to certain conditions specified by law.

Key Action Required:

Investors interested in obtaining the exemption must notify their intention to apply for aid before commencing the implementation of the investment project.

Exemptions apply throughout the entire city area.

Government grants

Government grants

Government grants are awarded on the basis of the “Programme of support to investments with enormous significance for the Polish economy for the years 2011 – 2023” adopted by the Council of Ministers on 5th July, 2011.

The support bears a form of subsidy, and conditions for payment are governed in detail by the agreement concluded between the Minister of Economy and an investor.

Applications for a subsidy are received by Polish Agency of Investment and Trade JSC.

More information:

European Union funding

European Union funding

There are numerous ways to obtain EU funding for the development of companies. Most applications are aimed at micro, small and medium enterprises which may apply, among others, for subsidies from the European Funds for a Modern Economy, European Funds for Eastern Poland, or European Funds for the Subcarpathian Region. Other than grants, preferential loans and guarantees are also offered.

Grants are intended for use mainly for Research and Development investment and the implementation of innovation, computerisation, development of activity within foreign markets and raising of qualifications of employees.

Other forms of support for investors

Other forms of support for investors

1) Cooperation with the District Employment Office in Krosno, including:

- professional assistance in finding suitable candidates for work in the recruitment process,

- increasing competences and skills of employees and candidates for employment: training courses, occupational preparation,

- apprenticeship work placements which have probationary periods for graduates,

- refund of the employment costs of employees up to the 30th year of life (maximum 12-month salary),

- a settlement voucher (aid for an unemployed individual in connection with starting employment outside their present place of residence),

- refund of the costs of equipment of a new work place for an unemployed individual,

- refund of costs of social security contribution in the event of employment of an unemployed individual,

- support for an employer on account of employing a disabled person: refund of employment costs, training, equipment and adaptation of a workplace).

2) Implementation of attractive housing programmes in the Municipality of Krosno.

3) Convenient public transport adjusted to the employees’ needs.

4) Comprehensive assistance on the side of the Municipality of Krosno in effective completion of investment procedures, post-investment assistance.

Municipal Office of Krosno

![]() ul. Lwowska 28 A

ul. Lwowska 28 A

38-400 Krosno

Head-office

City Development

and Investors’ Assistance Department: